By Matt Kissick

By

McKayl Barrows

Banking is a traditional space rooted in security and safety, and most banks weren't set up in the technical age with the digital-first mindset (unlike some of their newer digital competitors like Ally Bank, Discover Bank, and Wealthfront).

These days, traditional banks and financial services have an incredible opportunity to use advanced technology — generative AI, for example — to transform their customer relationships.

Related report: The Future of Experiences in Financial Services.

In this article, we'll break down the patterns we've seen in our research with digital banking customers and explain how you can use these insights to exceed customer expectations and improve the customer experience in banks.

What do people value most in a mobile banking or investment app?

We've noticed a few general patterns in what people look for when shopping around for a banking or investment partner. Here's what we found.

People want to know they're on track.

Reassurance around whether or not they're making healthy progress toward short-term and long-term financial goals is important for most customers.

They want to complete their goal in the same channel they started in.

If a customer starts a task on their phone, they want to complete it on their phone without having to switch to a tablet or laptop and vice versa.

Having access to easy-to-use technology is valuable.

Convenience is key! We found that customers value mobile banking and investment apps that are easy to use and accessible.

They want to talk to a human when needed.

Money is delicate, and situations around banking can be stressful. Customers want the ability to connect with customer service when something comes up.

Want to learn more about your specific users and their mobile banking needs? Conduct research and collect customer data with Blink.

Without further ado, here are seven ways to improve customer service in banking.

7 Ways to Improve Your Mobile Banking Experience

These general best practices can go a long way in improving your mobile app; however, every bank has a unique customer base and specific reasons why people choose to bank there.

The surefire way to improve your mobile banking experience is to conduct research and gather customer feedback on your own or partner with a UX agency to do the same. Still, these tips are an excellent foundation to get you started.

1. Focus more on the customer and less on selling

The best mobile banking apps are framed around customer problems. Identifying what problems your customers are trying to solve while using your app and designing the app to solve these problems creates a meaningful and straightforward experience for the customer.

Venmo does a great job with this customer-centered approach. The money transfer platform realized the customer problem first — people need an easy, secure way to transfer money. Now, Venmo offers a simple, user-friendly experience geared right toward the user's pain points.

There will always be opportunities to upsell new products and services, and a customer-centric mindset can help us do this in a user-friendly, tactical way. That way, the first thing customers see when they visit the app is how to pay off their current credit card instead of how to sign up for a new one.

2. Trim the excess

Banks have an incredible opportunity to audit their current mobile app experiences. Many banks started as brick-and-mortar branches that then created digital apps as apps became more popular with competitors and a necessary element of the banking customer journey.

Because of this, they've added advanced technology like automation onto what they already have versus starting from a clean slate, which can cause a cluttered experience for the user.

Traditional banks and finserv institutions can benefit from stepping back and asking, "How might we start this mobile app differently? Could we lead customers into this app experience in a more user-focused way?"

Auditing the current experience gives a unique opportunity to assess excess and find ways to streamline how a user engages with their app, putting the focus on their core needs first.

3. Give the setup experience some love

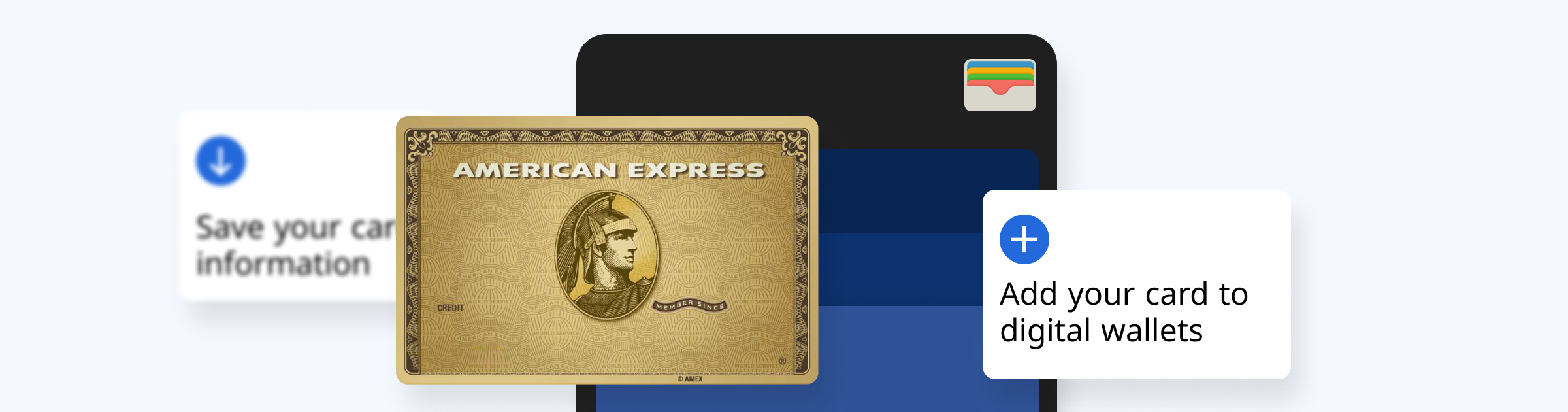

Have you ever opened an Amex card? They have an excellent experience because they're customer-first.

You apply for your card, log in, and the card is on your phone immediately instead of calling a number on the back of the card or having to go to an ATM. There is very little friction with the setup. A new onboarding experience needs to be seamless, and adding your information into an app needs to be easy as well.

Web and mobile app experiences have become our primary means of banking these days, and a best-in-class app design can significantly impact customer trust and brand loyalty. Clean, simple, polished designs make people more confident that their bank is a modern institution that protects and spends its money responsibly.

4. Guide through simple, straightforward language

Banking is a traditional space with many short forms — especially regarding mortgages, lines of credit, or other investments. Complex or unfamiliar terms can be a barrier to a seamless, engaging mobile customer experience.

Communicate in everyday terms that anyone can understand regardless of their financial literacy, and try to describe products by relating to member needs and concerns. When you need to use industry terms or acronyms, plain language is the way to go.

5. Lead with the big picture

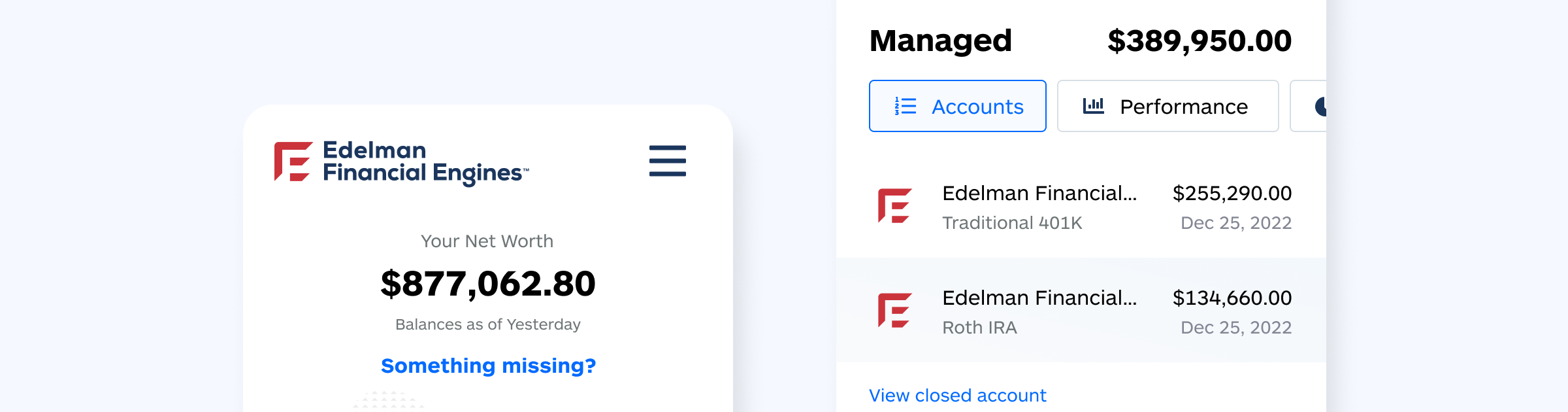

Giving customers assurance that they're on the right path is something we discovered is very necessary.

Reassuring customers and keeping them up to speed without overwhelming them is crucial. Traditionally, customers would have to go into a branch and ask for updates on their progress; now, they can check it whenever and wherever they want. Being up-front with the most significant numbers and letting your customers know they're on track to meet their financial goals is one way to show customers where they're at.

Banks can better support their customers by showing and reminding them that there are ups and downs, but over 30, 40, 50+ years, you'll likely make money if you leave it in the market.

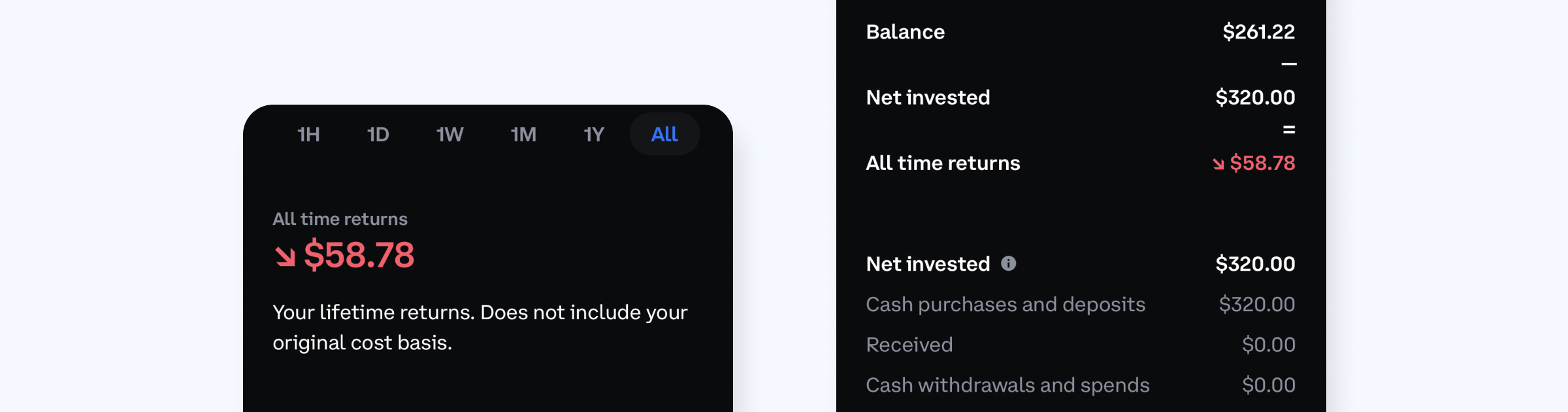

6. Show your work

Showing your work is all about pulling back the curtain, showing customers where their money totals come from, and laying out the details with simple equations when possible.

For example, here's the number and how we get there — you invested this much, it grew by this amount, and you have pulled out this amount of money, giving you this final number.

7. Highlight the important details

Transparency is significant in gaining customer trust. Be open about the rates, fees, and potential financial impacts that customers can expect with their new banking products and services. Helping customers make healthy financial decisions is the way to go, even if it goes against a bank's best interest at times.

Apple's Credit Card app does a great job of this by giving customers the right insights at the right time. Its payment screen allows users to understand potential interest charges based on contributions to the amount owed. Apple also breaks down payment activity categorically to make it easier to see where their customers can save.

It's all about understanding the user

When it comes down to it, improving your mobile banking app experience and increasing business outcomes is all about understanding your unique customers, applying good usability, and providing a great user experience.

Every bank is unique, and your customer base is, too. While these general best practices can go a long way in creating standout app experiences for your customers, knowing who your customers are and their daily banking problems will give you a huge advantage in increasing customer satisfaction and building a mobile banking app they love.